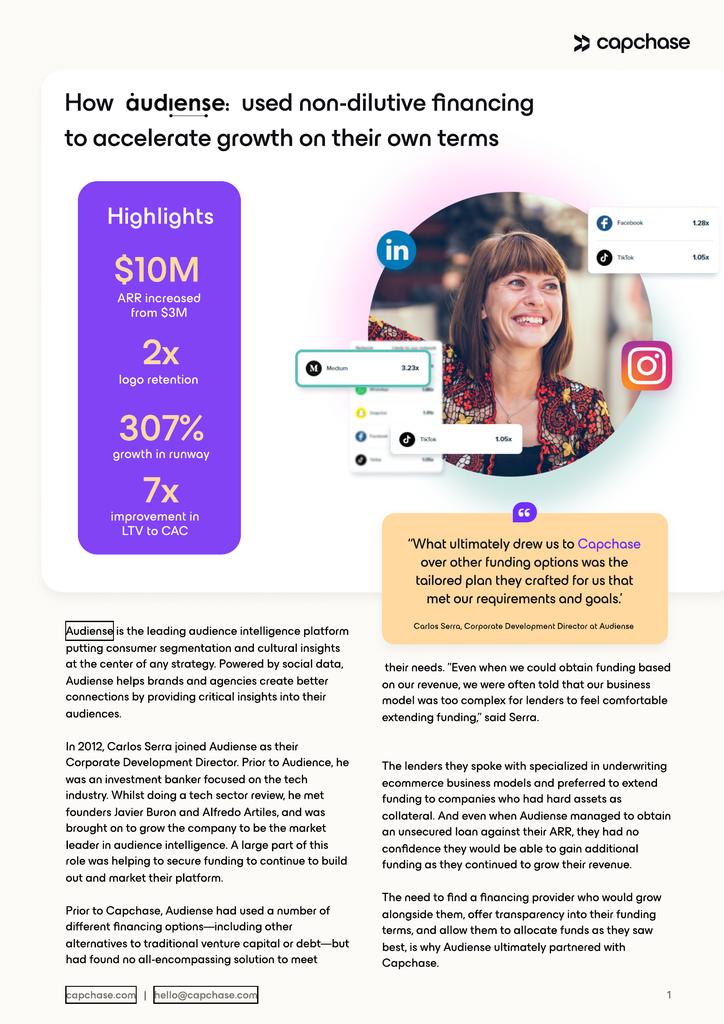

Accelerating your SaaS company’s success has never been easier. With Capchase, your recurring revenue business can get non-dilutive capital to invest in growth and help extend your runway. With a fast data-driven analysis process you can get access to fair flexible funding that works like a line of credit. This available funding can increase each month based on your overall ARR growth without the need to dilute your equity.

Why work with us

Capchase is the most flexible SaaS financing as our credit facility scales alongside your ARR.

- Low cost - flat fee on drawn amount and not the full credit facility. Cheaper than venture debt

- Unsecured - no covenants, PGs or security charges.

- No Dilution - no warrants.

- Fast decision - obtain your term sheet in days.

Eligible for B2B SaaS businesses with $100K-100M+ ARR and 6+ months of runway.

)